Click on the play button to listen to the audio version.

The disruption in the real estate market has me thinking about unintended consequences. I don’t think the lawyers and plaintiffs in the class action lawsuits that have triggered changes in how real estate is bought and sold in America care a lot about the impact on the market. They stand to make a lot of money, which is probably what they care about most. I don’t think much about them, but the proponents and advocates of the lawsuits also include many people I have admired in the past, who, for whatever reason, are on the wrong side of this issue. For them, the laws or unintended consequences need to be considered with more willingness to alternative viewpoints.

By definition, unintended consequences are the results of an action different from what was expected or planned. They are often referenced in relation to changes in policies. I have heard the term used for years, primarily related to government policies. Still, I didn’t realize until recently that much has been written on the subject, and most experts believe that there are three categories of unintended consequences: 1) unintended benefits, 2) unintended drawbacks, and 3) perverse results. Here is a little more detail on all three categories:

Unexpected benefits – As the name implies, these are positive but unplanned outcomes. These are benefits that are not part of the original plan. Adam Smith, the famous Scottish philosopher, described the “invisible hand” as one in which, in capitalism, people pursuing their self-interests actually provide social benefits such as more innovation and better consumer prices.

Unexpected drawbacks – This type of unintended consequence occurs when the goal is to improve “A,” we later learn that we made “B” worse in the process. These are also referred to as “externalities.” The mass adoption of the automobile in the early part of the 20th century provided many benefits but created unexpected drawbacks such as air pollution and car accidents.

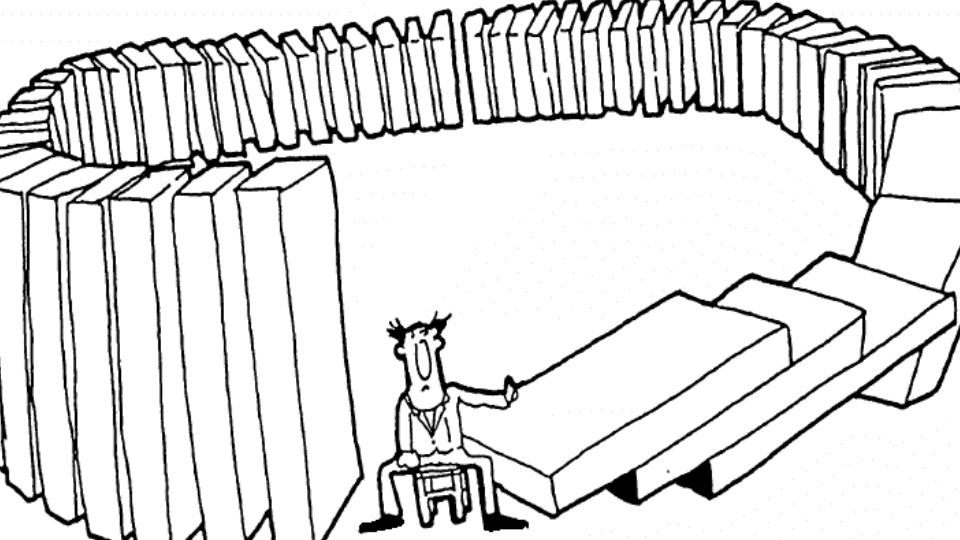

Perverse results – ‘Perverse Results’ happen when our goal is to improve “A” but we actually make “A” worse. These are often the most frustrating category of unintended consequences.

I think the current disruption in the real estate market falls into category three. The stated goal of the proponents of the class action lawsuits, including the U.S. Department of Justice, is to lower commissions and improve affordability for all real estate consumers. I don’t think the changes they are advocating will have that result; in fact, I think things will become more expensive for many consumers, especially those who can least afford it. To be clear, I don’t spend much time worrying about whether the sellers of million-dollar properties pay too much in commissions. I assume they will all be fine, but when I think about the potential changes in the real estate industry, I worry a lot about the impact on first-time home buyers and the small businesses that service them.

Anyone who has ever purchased real estate knows that one of the advantages buyers have is that they don’t have to pay out of pocket for their real estate agent. They can choose any agent they want to represent them, but that agent is paid from the proceeds paid to the seller. This lowers the barrier of entry for buyers and is especially helpful to first-time buyers who have to pay for everything with money saved. The proponents of the lawsuits think that by requiring buyers to pay for their agent out of pocket, commissions will have to get lower, and that will benefit buyers in the long run. That sounds a little like trickle-down economics. Reduce costs for the wealthy, which will trickle down to less affluent consumers. I think we know that doesn’t ever really work.

Perverse results happen more frequently when the goals are convoluted, and the desired outcomes are short-sighted. Along with the DOJ, The Consumer Federation of America has been a major proponent of separating the compensation between buyers’ and sellers’ agents. They both have stated that their reasoning is that real estate commissions in the United States are higher than in most other industrialized nations. But is that the correct issues to address? Why does it matter if commissions in the U.S. are one or two percentage points higher here than in Britain or France? Shouldn’t we be more concerned with whether our system is functioning efficiently and consumers are receiving commensurate value for the services they receive? When someone purchases a home in the U.S., the costs are transparent to everyone involved. Buyers and Sellers know exactly in advance what they have to pay.

Before the 2008 collapse of the housing market, mortgage lenders had very few regulatory controls. Most consumers who took subprime mortgages had no idea what they were getting. That has never been the case with the real estate agents. Everyone has always known exactly what they are paying.

Because we have title insurance, real estate buyers can be confident that when their deal closes, they are the legal owner of that property. This is not the case in many countries. MLS systems help create a more efficient market for home sellers. Title insurance provides certainty for buyers, and realtors offer advice, comfort, and advocacy to consumers during the largest financial transaction most people will undertake in their lifetime.

One of the things I love about the real estate industry is that hundreds of thousands of small businesses dominate it. Small businesses that, in some cases, have been in families for generations.

Commissions paid on a real estate transaction have almost no connection to the affordability problem we currently face in the housing market. For that, you can credit NIMBYism, exclusionary zoning, and regulatory burdens for homebuilders.

The misguided goals of those who want to dismantle the real estate industry will undoubtedly result in a less efficient market and higher costs for many consumers—a perverse result of the highest order.

For those in the industry, we will continue to educate policymakers on the unintended consequences of excessively disrupting the real estate market. For business owners, the lesson here is to make sure the goals you seek are correct and that you have properly considered all possible outcomes before you make big moves for your business. Good Luck!